Overview

The format and details of a Generate E-way bill API request is depicted in following table.

URL |

|

|---|---|

Content-Type |

application/json |

Method |

POST |

The format and details of a Generate E-way bill API request is depicted in following table.

URL |

|

|---|---|

Content-Type |

application/json |

Method |

POST |

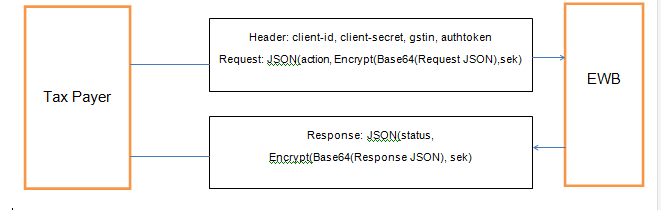

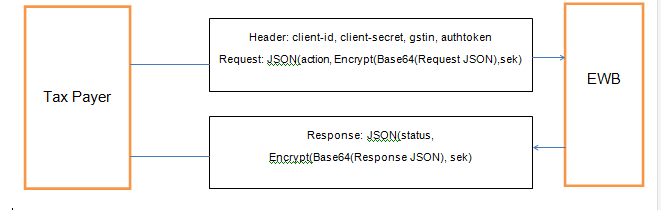

Request Header

| Attributes | Description |

|---|---|

| client-id | Client-id to be provided by E-WAY BILL SYSTEM |

client-secret |

Secret to be provided by E-WAY BILL SYSTEM |

gstin |

GSTIN of Requester(Tax payer or Transporter) |

authtoken |

Authentication token returned by the E-way bill system |

Request Payload

| Attributes | Description |

Values |

|---|---|---|

action |

GENEWAYBILL |

|

Encrypt (Base64(Request JSON),sek) |

Encrypted E-way bill JSON string |

Attributes |

Description |

Value |

|---|---|---|

status |

Status of request |

0 – for Failure ;1 – for Success |

Encrypt(Base64( |

Response of E-way bill JSON string, The response will have eway bill number and generated date if it is successfully generated. Otherwise the response will have error codes |

“data” JSON corresponds to the data element of Generate E-WAY BILL Request above

“data” JSON corresponds to the data element of Generate E-WAY BILL Response(Success) above

JSON(in case of error)

},

"required": [

"hsnCode",

"taxableAmount"

]

}

]

}

},

"required": [

"supplyType",

"subSupplyType",

"docType",

"docNo",

"docDate",

"fromGstin",

"fromPincode",

"fromStateCode",

"toGstin",

"toPincode",

"toStateCode",

"transDistance",

"itemList",

"actToStateCode",

"actFromStateCode"

]

}

| Parameter Name | Type | Description | Values | Sample Data | Allowed character |

|---|---|---|---|---|---|

supplyType |

Text(1) |

Supply whether it is outward/inward. |

Refer Code List |

O |

|

subSupplyType |

Text(2) |

Sub types of Supply |

Refer Code List |

2 |

|

subSypplyDesc |

Text(20) |

Su Supply Description if selected “Others” in subSupplyType |

|

|

|

docType |

Text(3) |

Document Type |

Refer Code List |

CHL |

|

docNo |

Text(16) |

Document No |

|

12 |

Alphanum, -, / |

docDate |

Text |

Document Date |

dd/mm/yyyy format |

12/09/2017 |

|

fromGstin |

Text(15) |

GSTIN of the Consignor |

|

29AAAAA0300L1Z8 |

Alphanum |

fromTrdName |

Text(100) |

LegalName of consignor |

|

ABHYUDHYA CO OP BANK |

Alphanumeric |

fromAddr1 |

Text(120) |

Address of consignor - Line 1 |

|

Shambhai Fortune |

Alphanumeric |

fromAddr2 |

Text(120) |

Address of consignor - Line 2 |

|

Behind KSRTC Bus Stop |

Alphanumeric |

fromPlace |

Text(50) |

Place of consignor |

|

Bengaluru |

Alphabetic |

fromPincode |

Number(6) |

Pincode of consignor |

|

576101 |

Number |

fromStateCode |

Number(2) |

State of consignor |

Refer Code List |

29 |

|

actFromStateCode |

Number(2) |

State of Supply |

Refer Code List |

4 |

|

toGstin |

Text(15) |

GSTIN of consignee |

|

29ACGPI2251K1ZJ |

Alphanumeric |

toTrdname |

Text(100) |

Legalname of consignee |

|

INDER CHHAJER |

Alphanumeric |

toAddr1 |

Text(120) |

Address of consignee - Line 1 |

|

PRIYADARSHANI LAYOUT |

Alphanumeric |

toAddr2 |

Text(120) |

Address of consignee- Line 2 |

|

MUDALAYAPALYA |

Alphanumeric |

toPlace |

Text(50) |

Place of consignee |

|

Bengaluru |

Alphabetic |

toPincode |

Number(6) |

Pincode of the consignee |

|

560072 |

Number |

toStateCode |

Number(2) |

State of Supply |

Refer Code List |

4 |

|

actToStateCode |

Number(2) |

State of Supply |

Refer Code List |

4 |

|

totalValue |

Decimal(18,2) |

Total Amount/ Taxable Amount |

|

2000 |

|

totInvValue |

Decimal(18,2) |

Total Invoice Value |

|

|

|

cgstValue |

Decimal(18,2) |

CGST Amount |

|

0 |

|

sgstValue |

Decimal(18,2) |

SGST Amount |

|

0 |

|

igstValue |

Decimal(18,2) |

IGST Amount |

|

240 |

|

cessValue |

Decimal(18,2) |

CESS Amount |

|

20 |

|

transMode |

Number(1) |

Mode of transportation |

Refer Code List |

1 |

|

VehicleType |

Char(1) |

Type of Vehcile |

R or O |

R |

|

transDistance |

Number(5) |

Distance of transportation |

|

10 |

Max Value = 4000 |

transporterId |

Text(15) |

Transporter Id |

|

29BQSPA3829E1Z0 |

|

transporterName |

Text(100) |

Transporter Name |

|

TAPURI |

|

transDocNo |

Text(15) |

Transporter Doc No |

|

11 |

|

transDocDate |

Text |

Transporter Doc Date |

dd/mm/yyyy format |

13/09/2017 |

|

vehicleNo |

Text(15) |

Vehicle No. |

Pl refer Code List |

KA12BL4567 |

Vehicle No. to begin with state code as given in the Code list |

productName |

Text(100) |

Name of the Product |

|

Steel |

|

productDesc |

Text(100) |

Description of the Product |

|

5mm Rod |

|

hsnCode |

Number(8) |

HSN Code of the Product |

|

10101 |

|

quantity |

Decimal(8,2) |

Quantity of Product in Numbers |

|

QTS |

|

qtyUnit |

Text(3) |

Unit of the Product, like Liter,Kg etc |

Refer Code List |

200 |

|

taxableAmount |

Decimal(18,2) |

Total Amount/ Taxable Amount |

|

100000 |

|

cgstRate |

Decimal(6,3) |

CGST Rate |

|

9 |

|

sgstRate |

Decimal(6,3) |

SGST Rate |

|

9 |

|

igstRate |

Decimal(6,3) |

IGST Rate |

|

18 |

|

cessRate |

Decimal(6,3) |

CESS Rate |

|

0 |

|

cessAdvol |

Decimal(6,3) |

cessAdvol |

|

0 |

|

A. As of now this scenario is not available through API

A. Yes, Number of items per E Way Bill is limited to 250

A. Yes, Multiple E Way Bills can be generated for same document, E Way Bills other than the one required can be cancelled using Cancel API within stipulated time

A. Delivery Challans may be created for the goods being carried in each of the vehicles and using the respective delivery challan, one E Way Bill per vehicle can be generated. Last vehicle can carry the Invoice