Overview

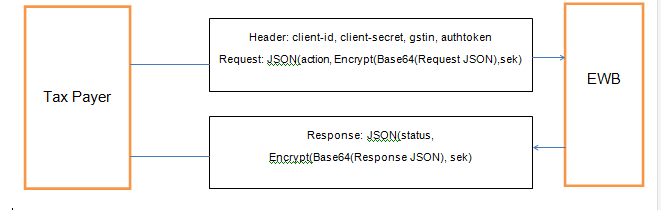

The format and details of a Generate E-way bill API request is depicted in following table.

|

URL |

|

|---|---|

Content-Type |

application/json |

Method |

POST |